France is an international student’s dream – enjoy the French culture, food, arts, and history all within arms length. If you plan to study in France, one important consideration is the health care. Like many other neighboring countries, France offers its residents national health care. If you are a Chinese international student planning on studying in France, you may wonder if you are eligible for the French health care as well. Eligibility, however, will depend on your age and how long you will be enrolled in full-time classes. Because of this, we have put together a helpful guide to help determine your health care options as you study in France:

France is ranked number #1 in health care around the world according to the World Health Organization so you can rest assured that you will have access to world-class quality health care. For students who have access to the social security system, you will have access to high coverage at affordable rates. In 2010, students paid 198 euros for a year of coverage. If you are not eligible for the national health care, plan to travel to multiple countries, or would like additional coverage to reduce your out-of-pocket expenses, you may consider purchasing a private insurance plan for France.

Many colleges and universities offer international student health insurance coverage. However, these plans can be expensive especially for international students. While some universities require their students to buy the school’s insurance plan, many other universities realize that their plan may not be suitable for every international student. At these universities, you have the option to waive out (decline) of the school’s insurance policy if you can show proof of an alternate insurance policy.

To help you determine if our international student health insurance plan will meet your school requirements, check out our School Requirement Database for schools in the USA. We have multiple plans that will work for international students as well, so if you have any questions feel free to contact us and we can help find a plan that would fit your needs.

Today we launched a new online application for our International Student Health Insurance plan. The new online tool now allows you to get a free quote and apply for the Student Secure Smart, Budget or Select level using the same link. You no longer have a different application link to apply for the Smart level of the plan. I will be going over the steps on how to complete this new international student health insurance application.

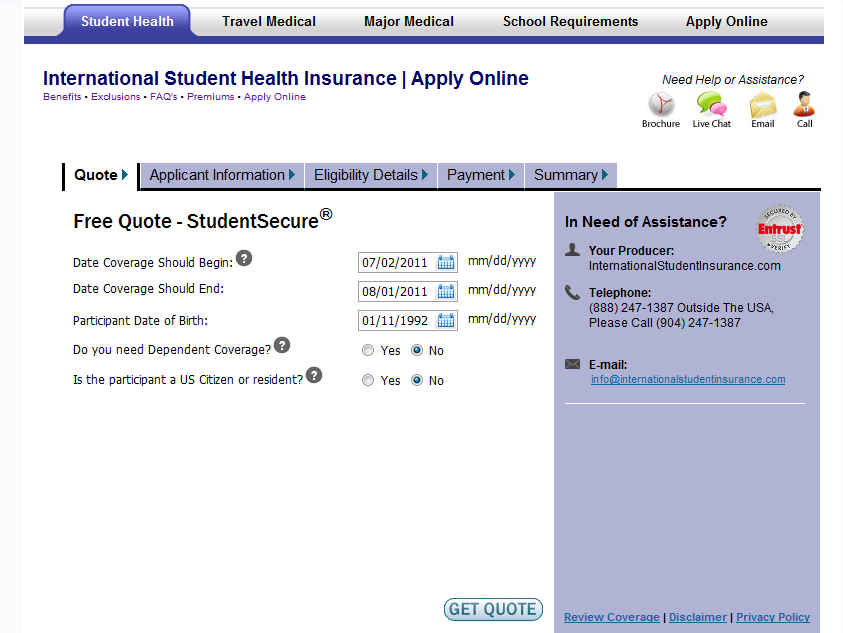

The first step of the application process is to get a free quote based on your situation. You will have the option of choosing when you want your insurance to begin and end – you can choose to have the plan start in the future or as early as the same day. You cannot choose a date that is in the past. You can choose to have the plan for as little as one month or up to 12 months.

Next, you would enter your date of birth. If the student needs to add a spouse or child, you can click “yes” to dependent coverage and input their dates of birth, otherwise click “no”. After you will answer the question asking if you are a US citizen or resident, please note that if you are an international student studying in the US with a temporary F-1 or J-1 visa, you are not a US permanent resident and you would answer “no” to this question. Once you have filled out the information click on “GET QUOTE” at the bottom of the page and you will be taken to the next page showing you the price for the number of months you chose to have coverage for in the previous step.

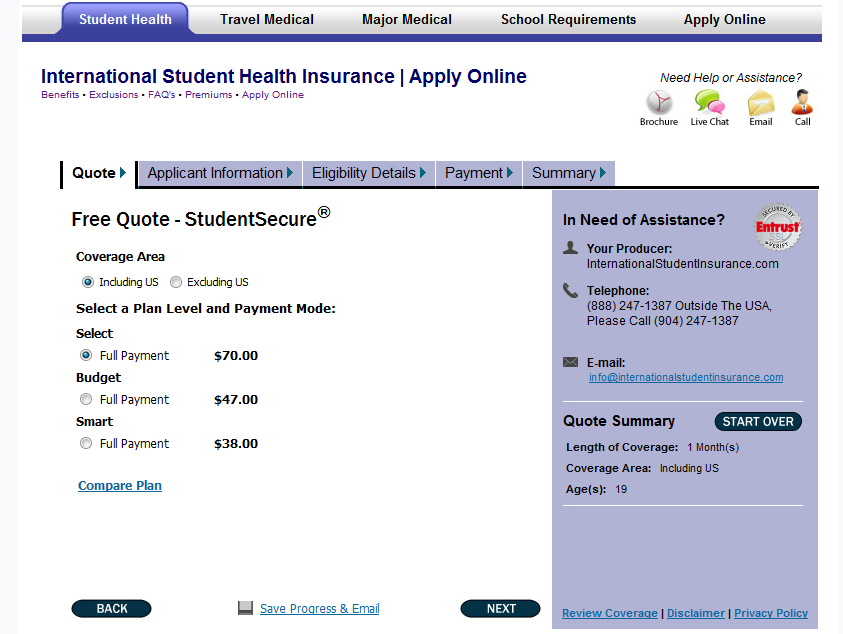

On the next page you will have the option to choose the Coverage Area, if you will be an international student in the USA you would need to click the option “Including US” since you will need the insurance to cover you while you are inside the USA. If you will not be needing coverage in the USA you would choose “Excluding US”. Next you will choose with plan level you want to purchase: the Select, Budget or Smart level. You will then indicate whether you want to pay for the plan in full right now or pay monthly. Click on “NEXT” in the bottom right to move to the next page.

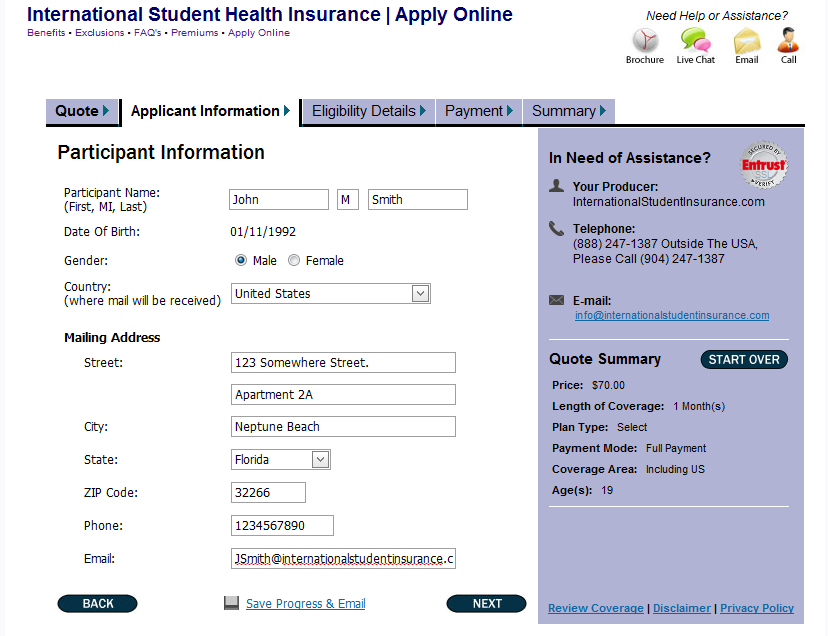

On this page you will simply fill out some information about yourself and your contact information. Your mailing address should be the address where we can reach you. Please be sure to fill out an email that you check regularly as this will be the primary way we will contact you about your policy including where we will send your documents and respond to other requests.

You might notice on the right hand side of the page that you can review the summary of your application so far.

Again, when you have filled out all the blanks click on “next”.

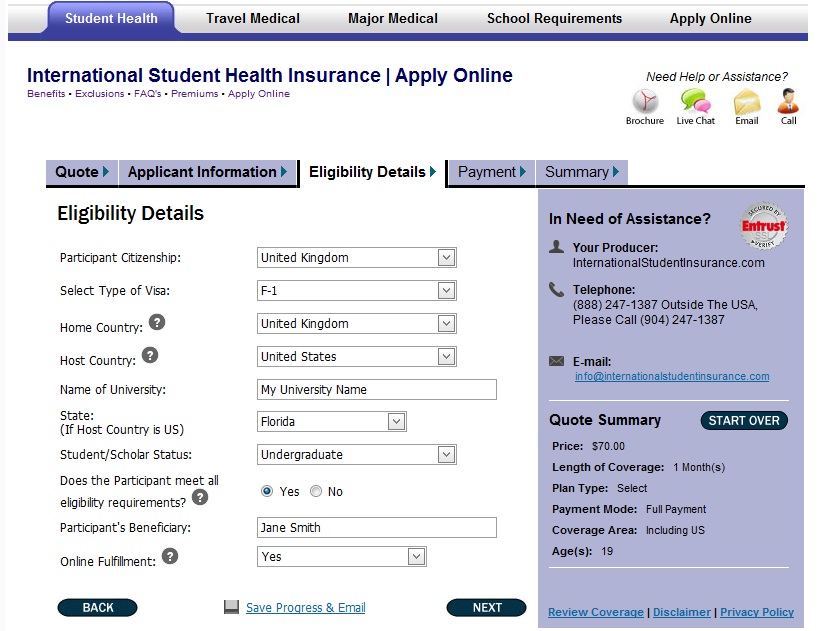

In the Eligibility Details page you will fill out your citizenship, home country and host country. In most cases your home country will be the same as your country of citizenship. If you choose to have coverage in the USA, you will have the question “Select Type of Visa” if your visa type is not listed you would choose “Other”.

The beneficiary for the accidental death benefit is the person you’d like to receive the monetary payout in case you pass away. This person can be anyone you want; usually it is a family member.

In the “Online Fulfillment Option” by choosing “Yes” you will receive your insurance documents electronically immediately after you complete the application. If you choose “No” you will get the documents physically email to you instead.

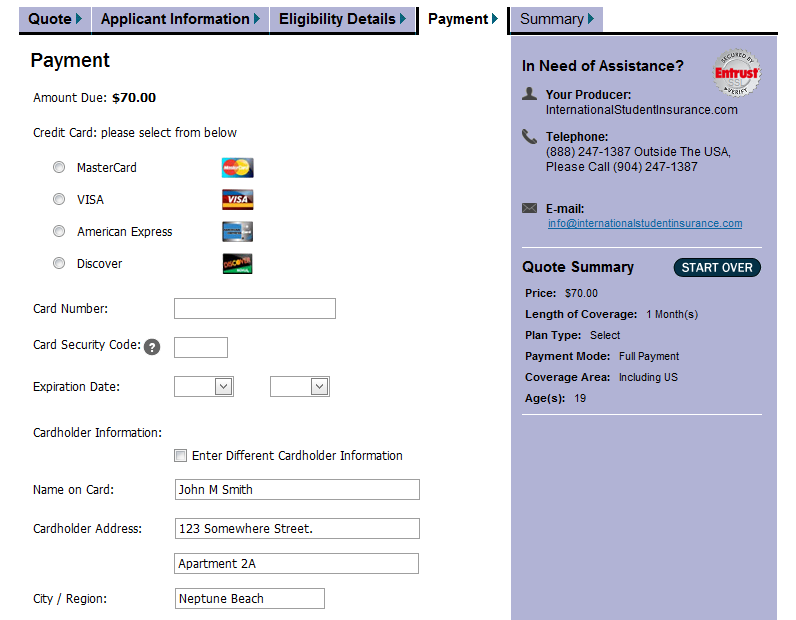

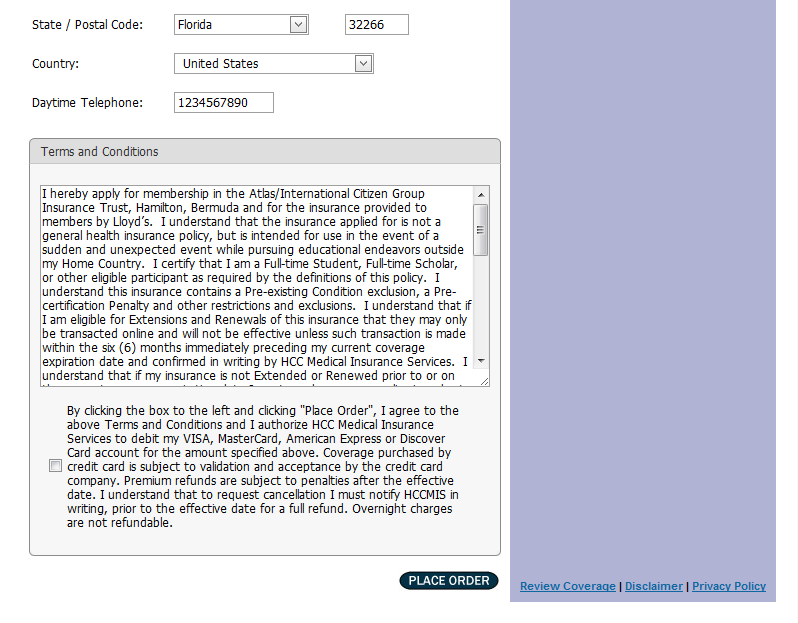

Congratulations, once you’ve reach this point you are almost done with the application. On this page you just need to confirm the price of the plan and include your payment information. You can use a credit, debit or bank card as long as they are MasterCard, American Express, Discover or Visa. Please keep in mind that “Visa Electron” is not accepted.

Once you have fill out all the information, read through the terms and conditions and click the check box if you agree then hit the “Place Order” button to submit your application!

It’s summer time and that may mean that you are planning to take a few months to study abroad. For others, this may mean a relaxing break just in time to start anew for the next school year. If you plan to study abroad in the Fall or Spring semester, it is not too early to prepare for this once in a lifetime experience. Whether you plan to study in China, Britain, or Australia, you will want to do your research and make the most of your experience!

To keep you at your best, many students purchase a study abroad insurance that will cover them outside their home country in case of sickness or accident. Some schools may require you to enroll in their school’s insurance plans, while others may offer the option to purchase your own policy. In either case, it is important to make sure that you are properly insured when you are overseas. Students will need to contact their study abroad office to find out about their insurance requirements and details on their plan. Some school insurance policies only cover students during their program – but what happens if you come early or stay late? Some insurance policies are emergency-only, but what if you have a cold and you want to seek treatment? Perhaps your school’s plan only covers you in one country, but instead you are plan on spending your free time traveling to other countries?

Investigate your study abroad insurance and make sure that this is the proper plan for you. If your school does not offer insurance, or if coverage is limited, you may decide to purchase your own study abroad insurance plan. Many countries have a different health care system than what is offered in the US so it is important to read the plan benefits and see what travel assistance they offer included in the plan.

Each year throughout the United States, Americans celebrate Independence Day, which is a national holiday commemorating their independence from England in 1776.

Next week is the start of the 4th of July weekend; many people will be traveling around the country during this holiday. The most common activity during the Fourth of July is to watch a fireworks show. Other activities like attending parades, having picnics and barbecues are also popular.

For international students in the USA, this is a great chance to experience a unique American holiday. Use the long holiday weekend to take a road trip to a major US city where the firework shows are usually more spectacular. If you are traveling into the US, make sure you have a good travel insurance policy that would be able to cover you on your travels.

Are you planning to travel outside your home country? Whether you plan to travel internationally for a few months or a few years, you may want to consider purchasing a visitor insurance plan. There is nothing like being outside your home country while you get sick or injured, especially if you are unfamiliar with the health care system. Instead, protect yourself and family members by purchasing a visitor insurance plan that will cover you while overseas for doctor visits, hospitalization, emergency medical evacuation, repatriation, prescription medications, etc.

By doing this, you are ensuring that you will be able to seek the treatment in case the unexpected happens. It is important to consider what type of coverage you are looking for – do you want a standalone emergency medical evacuation and repatriation plan, a travel health insurance plan to cover you outside your home country, or a comprehensive annually renewable health insurance plan? By deciding on the type of visitor insurance plan you are looking for, you will be able to narrow down your choices.

Most international policies also provide travel and medical assistance that is invaluable. Before purchasing an insurance plan, make sure that the assistance is 24 hours and check before to see if there is an international number. Whether you need pre-trip health and safety advisories, medical referrals, embassy or consulate referrals, a number of plans offer an array of services. Some plans even assist with translations and interpretations, bail bonds, and lost passport/travel documents! Contact one of our licensed agents to see our our visitor insurance plan can help you!

Once you have an insurance policy with International Student Insurance (whether it is the Student Secure plan, the Atlas plan, or the Citizen Secure plan), you can rest assured that you are protected in the event that you get sick or have an accident while traveling or studying abroad.

Whether you go to the doctor or hospital, your provider will expect to be paid for any services and treatments given during your visit. Depending on your provider, your doctor or hospital may accept direct payment from the insurance company, or you may need to pay first and then be reimbursed.

Some insurance plans have a network of doctors and hospitals that are contracted to accept direct payment. This means that your expenses will be paid directly from the insurance company to the doctor or hospital. With the Student Secure, Atlas or Citizen Secure plan there is an optional network you can use called the CMN Network. If you choose to go to an in-network provider, they have agreed to accept direct payment. If you go outside the network, it will be up to the provider on how they want to receive payment.

If you have already paid for the doctor visit or your provider requires you to pay upfront, you will need to file a claim. To do this, you will need to attach your bills, receipts, and a Claimant Statement to show proof of claim. With the Student Secure, Atlas Travel, and Citizen Secure plan, this information can be submitted by email, fax or mail. Once your claim is received and reviewed, you will receive an Explanation of Benefits and reimbursement. Your Explanation of Benefits outlines what medical treatment and services were paid according to the benefits on your insurance plan. This help you know what is covered and to make sure that your insurance plan is working for you!

In today’s environment where individuals travel overseas frequently, it is important to have a plan that includes coverage for emergency medical evacuation.

That brings up the important question, what is emergency medical evacuation?

For those of you who don’t know, emergency medical evacuation – also referred to as “med evac” – provides transportation from one facility to another in the event that medical treatment cannot be provided locally. This benefit can refer to transportation to 1) another facility within your host country, 2) another facility in another country or 3) another facility in your home country. The location is typically decided based on doctor recommendations and most plans will cover the closest facility that is recommended.

Depending on the plan you are interested, benefits may vary in terms of what the plan provides.

One popular option is our Liaison Traveler plan which is designed to offer emergency medical evacuation, repatriation of mortal remains, accidental death and dismemberment, and other incidental coverage and services for persons traveling outside their home country. This plan provides $250,000 for emergency medical evacuation alone! Additionally this plan is offered in various coverage period to allow you to get the coverage you need!

When purchasing a medical insurance plan, many times you will have the option of choosing what deductible you want to have on your plan. Many people often ask me when buying health insurance “what deductible I should pick?”

The answer will depend on your own personal situation. But first, you need to have a better understanding of what is a deductible. There are some things you should consider when choosing a deductible while purchasing health insurance.

– How much premium can you afford and how much of a deductible can you pay if you incurred claims? Having a deductible is like you sharing financial risk if you get sick or injured with the insurance company, a higher deductible means you are putting more financial risk on yourself because if you get sick you would pay more towards any medical bills upfront. As a benefit for having more upfront financial responsibility of your claims, the cost of your insurance plan will be less.

– Since higher deductibles mean lower premiums, then consider your budget, you can save money now by choosing a higher deductible, but keep in mind what you can afford if something major does happen. You will have to pay your deductible before the insurance makes any payment for claims.

– If you need health insurance to apply for a visa to travel to other countries or to register with an organization like a University, make sure to verify any medical requirements with the organization prior to purchasing. You may have to choose a particular deductible or coverage amounts in order to meet their requirements.

What deductible do to pick when buying health insurance

When you want to buy apurchasing a medical insurance plan, many times you will have the option of choosing what deductible you want to have on your plan. Many people often ask me when buying health insurance “what deductible they I should pick.?”

The answer will depend on your own personal situation. But first, you need to have a better understanding of what is a deductible is. Once you know what a deductible is here There are some things to you should consider when picking choosing a deductible while buying purchasing health insurance.

– How much risk you want to have on yourselfpremium can you afford and how much of a deductable can you pay if you incurred claims?. Having a deductible is like you sharing financial the risk of if you getting get sick or injured with the insurance company, a higher deductible means you are putting more more financial risk on yourself since because if you get sick you would pay more towards your any medical bills upfront. As a reward benefit for having more upfront responsibilityfinancial responsibility sharing more of the riskof your claims, the cost of buying your insurance plan will be less.

– To go along with the first point,Since the higher the deductibles you mean have the lower the premiums, to buy the plan. Sothen consider your budget, you can save money now by choosing a higher deductible, but keep in mind your what you can afford if something major does happen. as well. You will have to pay your deductible before the insurance makes any payment for claims.

– If you need health insurance to apply for a visa to travel to other countries and or to register with an organization like a University, make sure you to checkverify any medical requirements with your the organization prior to purchasing. to know if you mustYou may have to choose a particular deductible or coverage amounts in order to meet their requirements.