How to transfer schools (community college or other US university)

February 14th, 2025 by Sarah McCawleyMany students transfer schools for various reasons— whether the school isn’t a great fit, they want a different program, they have changed their degree plans, or because of financial reasons. If you find yourself in a similar position, you might be wondering what the process of transferring is like and how to begin. As an international student with an F-1 visa, you are eligible to transfer.

Reason: First things first, it’s important to be sure about why you want to transfer, as this will not only ensure you are making the right decision, but will also help you remain steadfast and confident in your decision throughout the process, as well as honing your future decision-making skills.

Plan: Next you’ll need to figure out where you want to transfer. Perhaps the why might have something to do with where, and you already have a school in mind, or it might be completely unrelated. Thus begins the college search yet again. With your newfound knowledge, make lists of what you like and don’t like, want and don’t want, in a school. Visit the campuses if possible and as you see fit. If you’re unsatisfied with your current situation, it’s important to find a school that feels different so that you don’t end up in the same situation.

Discuss: Talk to your advisor. They will be able to guide you through the process, direct you to necessary resources in the registrar and financial aid office, and help you figure out which credits are transferable. Deadlines may differ depending on when you want to transfer, so make sure to know the timeline.

Apply: Once everything is in order, it’s time to apply. Stay on top of any deadlines and fees, and be transparent with your advisor if you are struggling to meet any requirements. After you’ve hit submit on your application, it’s time to wait.

Make the switch: Once you have received an acceptance letter, thus begins the official process of transferring. You must bring the following documents to your designated school officer (DSO): Written Confirmation of Acceptance to another Student and Exchange Visitor Program (SEVP)-certified school, contact information for the new school’s DSO, and the Student and Visitor Exchange Visitor Information System (SEIVP) school code of the transfer-in school. With all the proper documentation, your DSO can begin working with you and the DSO of your new school to decide on a transfer release date, or when your new DSO takes responsibility for your SEVIS record. Upon your transfer release date, the DSO at your previous school will no longer have access to your files. You will need to get a new Form I-120 signed by your new DSO as soon as possible. Along with contacting your new DSO, you must register for classes within 15 days of your program start date.

Start your new journey: Turn in any deposits, complete any housing forms, or anything else you might need to complete to secure your spot. Prepare yourself for new opportunities, friendships, and wonderful memories.

Begin your journey as a transfer student with determination that this new experience will be even better than the last, and congratulate yourself for going through the school search process again– you should be proud of yourself for making decisions that are right for you.

What is a Deductible?

December 5th, 2024 by Debra MerrittA deductible is the amount you will pay when you see a doctor or hospital before insurance will pay any

part of the visit.

There are two different types of deductibles:

Deductible per policy period:

Once you have paid an amount equal to the deductible for medical bills (one or several that all add up to the amount), you will not have to pay the deductible again until you renew.

The amount of this type of deductible is usually higher than the per-injury/illness deductible.

For instance, if your deductible is $500, you go to the doctor for a covered expense, and the bill is $200. A week later, you go to another doctor for a covered expense, and the bill is $300. You would be responsible for paying the full amount of both doctor bills. The amounts added together total $500 which equals the deductible for your policy. The insurance would cover any visits, according to the policy details, after that.

Our Atlas Travel plan and Patriot Travel plan have this type of deductible.

Deductible per injury or illness:

This type of deductible works similar to a co-pay. You would pay the designated amount each time you

see a doctor for a new covered illness or injury. If you see a doctor for the same injury or illness more

than once, you would only pay the deductible for the first visit.

For instance, if you broke your leg, saw the doctor for treatment and he wants to see you back in a week

to follow up on your healing progress, you would not pay your deductible again for the follow-up visit.

Our ISI Advantage plan and Patriot Exchange plan have this type of deductible.

Appealing a Denied Health Insurance Claim

November 15th, 2024 by Alexis PonceDealing with uncovered medical expenses can be a very stressful experience that causes high levels of anxiety, especially for students and international travelers located far from home. For this reason, it’s important that you understand which are the options available to you if you disagree with your insurer’s decision to deny your claim.

Appealing a denied health insurance claim can be a challenging process, but knowing the steps to take and your rights can make a big difference. If your insurer has denied coverage for a medical treatment or procedure, you’re not alone. Follow this guide to understand how to submit an effective appeal and improve your chances of success.

1. Understand the Reason for the Denial

Before planning your appeal, the first step is to carefully review the denial letter from your insurer. This should clearly state the specific reason for the denial. Common reasons include:

- Treatment considered elective and not medically necessary.

- The treatment received for an injury or illness was not covered by the policy, meaning it falls under the policy’s general exclusions. Common exclusions that can lead to a denied claim include pre-existing conditions or medical expenses associated with routine or preventive care.

- Insufficient or contradictory information included in the medical records.

Once you have identified the reason for the claim denial, it is very important to review the terms and conditions of your policy, especially the coverages and exclusions. Your insurance coverage certificate will be accessible to you immediately after completing the purchase of your insurance.

If the medical expense incurred is listed as an exclusion in your policy, it is unlikely your insurer will reconsider the claim, even if you file an appeal. However, using an example, if the claim denial was due to an alleged pre-existing condition and you have evidence to prove that this determination was incorrect, then it’s recommended to appeal. Keep reading to learn more about what documentation you’ll need to prepare your appeal.

2. Gather Relevant Documentation

For an effective appeal, gather all the necessary information and documentation to support your case. This could include:

- The insurer’s original denial letter so they can identify the claim you wish to appeal.

- Medical records. For example, if the reason for denial was that the illness was pre-existing, the medical records you attach should prove that the condition in question was not pre-existing.

- Letters from your doctors.

- Summaries of benefits and the insurance policy describing the coverage.

This documentation is essential to support your case and demonstrate that the requested treatment is necessary.

3. Understand the Timeframes and Types of Appeals

In the U.S., insurers generally offer two types of appeals:

- Internal appeal: Conducted within the same insurance company, and this is the first step in the process.

- External review: If the internal appeal is denied, you can request an independent entity to review your case. This is mandatory in most states and managed by an impartial third party.

The timeframes for filing an appeal vary depending on the insurer. Some insurers give you a period of 90 days after the denial, while others allow up to 180 days to file your appeal. It is very important to review your policy to ensure you meet specific deadlines, as if the insurer receives your appeal outside the stipulated timeframe, it will not be processed.

The timeframes for filing an appeal vary depending on the insurer. Some insurers give you a period of 90 days after the denial, while others allow up to 180 days to file your appeal. It is very important to review your policy to ensure you meet specific deadlines, as if the insurer receives your appeal outside the stipulated timeframe, it will not be processed.

4. Write Your Appeal Letter

Writing a clear and concise appeal letter is key to presenting your case. Here are some tips:

- Start with a summary that includes your policy information, the denial date, and a brief description of why you’re appealing.

- Explain the treatment and its importance, supported by statements from your doctors.

- Argue how the treatment meets your policy terms and refute the reason for the denial (for example, if they consider it unnecessary, explain why it is).

- Attach all supporting documents.

A well-structured letter can demonstrate that the treatment meets policy criteria and medical necessity.

5. Regularly Follow Up on Your Appeal

The appeals process can be slow. Insurers generally request up to 90 days to review the appeal and provide a new determination.

It is important to stay in contact with the insurer, confirm that they have received all your documents, and regularly check the status of your appeal. Keeping a detailed record of all calls, representative names, and dates can be very helpful to have a complete history of your case.

My Appeals Were Denied, Now What?

While there are many cases where appeals are successful, unfortunately, the reprocessing of claims does not always result in payment. Although this can be discouraging, there are still other options for dealing with uncovered medical expenses.

Hospitals have financial assistance departments where you can explain your situation. In some cases, the medical provider may reduce the debt or offer a payment plan with affordable monthly installments to help you pay off the debt. To review different ways to deal with uncovered medical expenses, we recommend checking out our blog “How to deal with medical debt in the US”.

Appealing a health insurance claim in the U.S. can be a complex and time-consuming process, so it’s important to understand the steps to follow to prepare the documentation and arguments you’ll use during your appeal to increase the chances of the best resolution. It is essential to know and understand your policy’s coverages and exclusions, as well as the deadlines set by your insurer to submit your appeal so that it can be processed in a timely manner.

How stress shapes our world

September 30th, 2024 by Angela PerrilliatIt may seem like stress is a very modern problem but it has always been there, the difference is that in today’s world we are now extremely aware of it, mention it, and acknowledge it as an everyday part of our lives. Now, although humans can share the same stressful experiences and situations, how we perceive and face them is totally different.

The first step of approaching this is recognizing the role stress plays in our lives. Even though it is a constant, we must not underestimate it. First, we will approach how the body is affected by stress, and after you will read how it affects our minds and the way cognition is sort of impaired, therefore shaping our world in a much different way than the next person.

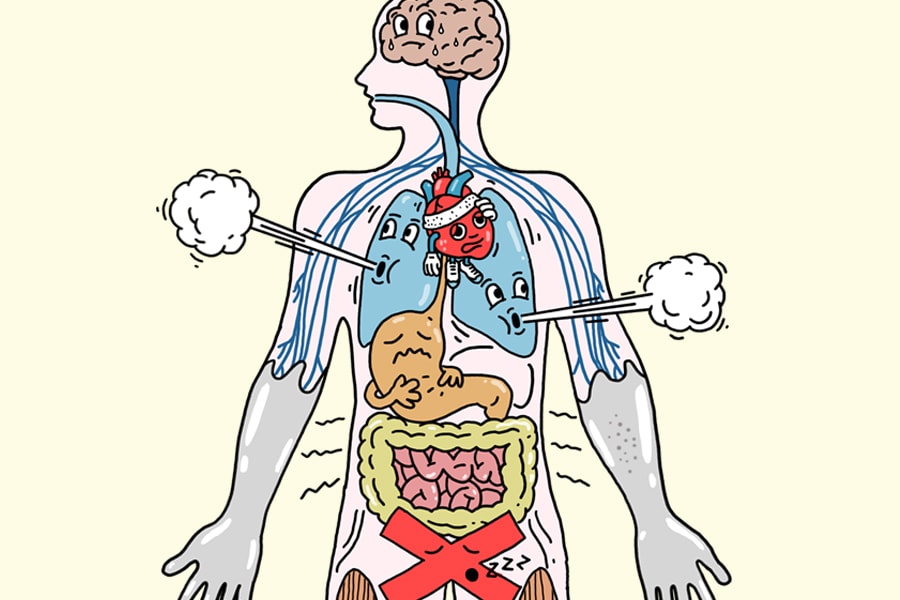

Physical Signs

- When the body is stressed, muscles tense up. Muscle tension is almost a reflex reaction to stress and when it is chronic, you are likely to present headaches, migraines and pain in the low back and upper extremities.

- Shortness of breath and rapid breathing can happen, as the airway between the nose and the lungs constricts.

- Acute stress causes an increase in heart rate and stronger contractions of the heart muscle, with the stress hormones flooding your body.

- As for the gastrointestinal system, stress may trigger pain, bloating, and overall gut discomfort. Also, when stressed we may eat much more or much less than usual which can result in heartburn or acid reflux.

- As for the male and female reproductive system, both libido and capacity for reproduction can be limited or even impeded. For the female reproductive system, processes such as pregnancy, premenstrual syndrome and menopause can be severely affected.

The mind and our cognition

Now that you’ve learned about the physical tolls the body has to take on you may be starting to realize how it is for the mind and our mental well-being to constantly be in discomfort.

Stress affects our emotional state and makes interacting with the world difficult, but what may be less obvious is how it changes what we focus our attention on throughout the day. By biasing attention, stress alters what we are conscious of, and in turn, the way we experience reality.

Imagine how it would be if you were only focused on your internal experiences and not being able to appreciate other external situations that are not negative or harmful.

Other cognitive impairments we can have due to stress are the constant worrying; rigid thinking, which makes us more likely to make decisions out of habit; and poor judgment, where we could be more impulsive than usual or simply fail to think decisions through.

After learning all of this, we hope you now have a wider view of all of the factors that come into play when we are living a life with constant stress and the importance of managing it properly so as to have a better well-being.

For more information about stress and mental health you can go to our ISI Insurance Explained section: Emotional & Mental Health for International Students.

New Student Secure Benefits for the 2024-2025 School Year

August 1st, 2024 by Jennifer FrankelAre you an international student studying in the U.S. or planning to study in the US this year? International Student Insurance (ISI) recently rolled out significant updates to their Student Secure plan for the 2024-2025 school year, bringing you enhanced coverage and benefits.

What’s New in the Student Secure Plan?

The Student Secure plan, designed to meet the needs of international students, scholars, study abroad participants, exchange students, and those on Optional Practical Training (OPT), now offers more comprehensive coverage. Available in four levels—Smart, Budget, Select, and Elite—these updates ensure that you get the best possible healthcare without breaking the bank. Here’s a quick rundown of our updated benefits:

- $0 Deductible and Copay Structure – All plan levels now feature a $0 deductible and a copay structure, making it easier to manage your healthcare costs and meet your insurance requirements.

- Wellness/Preventative Care – The Elite plan covers wellness and preventative care after six months of continuous coverage, helping you stay healthy during your studies.

- Contraceptive Coverage – The Elite plan now includes coverage for contraceptives, providing you with a more comprehensive health insurance plan.

- Sports Coverage – Love sports? The Select and Elite plans now cover organized sports, including intercollegiate, intramural, and club sports, without needing an add-on.

- Enhanced Maximum per Injury or Illness – The Select plan now offers increased maximum coverage per injury or illness, ensuring you have ample support if you get sick or injured.

For a more detailed comparison of the benefits, visit our Student Secure plan:

https://www.internationalstudentinsurance.com/student-health-insurance/benefits.php

Why Choose the Student Secure Plan?

The Student Secure plan has been the choice of thousands of international students across the country, thanks to its design that meets their unique needs. Our team offers superior customer service, guiding you through understanding your plan benefits, deciding which plan is right for you, and helping you waive your school’s insurance plan. The process is quick and easy, potentially saving you hundreds or even thousands of dollars!

Ready to Learn More?

To learn more about the plan, visit our Student Secure online:

https://www.internationalstudentinsurance.com/student-health-insurance

The goal of the updated Student Secure plan is to provide international students with the best possible coverage, allowing them to focus on their studies and experiences without worrying about healthcare costs. These enhancements reflect ISI’s commitment to support the well-being of our students.

Peace of Mind for Travelers: Emergency Medical Evacuation and Repatriation of Remains Insurance

July 18th, 2024 by Joss JimenezTraveling the world opens doors to incredible experiences, but it also comes with inherent risks. Unexpected medical emergencies can happen anywhere, and the costs associated with them, especially in remote locations, can be astronomical. That’s where emergency medical evacuation and repatriation of remains insurance comes in.

What is Emergency Medical Evacuation and Repatriation of Remains Insurance?

This type of insurance provides financial protection in case you require medical evacuation to a better-equipped facility or to your home country to get treatment or need your remains repatriated to your home country in the unfortunate event of your passing abroad.

The U.S. Department of State mandates that all J-visa holders have health insurance that includes emergency medical evacuation coverage of at least $50,000 and repatriation of remains coverage of at least $25,000. This ensures that J-visa holders can access necessary medical care and have their remains returned home in a dignified manner.

Get Covered with ISI:

Our Student Secure plan, in addition to healthcare benefits in the case of an illness or accident, offers robust evacuation and repatriation coverage, fully conforming to J visa regulations.

If you have health insurance elsewhere and would like to have complementary evacuation and repatriation coverage to bolster your peace of mind or to comply with the J visa requirements, our Medical Evacuation plan is a great option. It is also ideal for international students on an ACA compliant plan that does not have these benefits included. The plan can be purchased for 3, 6 or 12 months. To see a detailed list of benefits, you can visit this site.

In conclusion, emergency medical evacuation and repatriation of remains insurance is an essential investment for any traveler. It provides invaluable peace of mind and financial protection in case of unexpected medical emergencies abroad. Choose ISI for reliable and affordable coverage, and embark on your next adventure with confidence!

Alternative Insurance Plan for NYU Students

July 12th, 2024 by Maria CaballeroFor international students studying at New York University (NYU), you have the option to choose the school insurance plan or select an alternative option that meets the waiver requirements. Read this article to learn more about how the waiver process works when you purchase our Student Defender plan to waive the NYU school insurance.

What is the plan option through ISI that meets NYU’s waiver requirements, and how does it compare to NYU’s plan?

| Plan Comparison | NYU Plan | Student Defender Plan |

| Cost | $4644 per year | Starting at $1,188 per year |

| Network | Cigna OAP | Aetna Passport PPO |

| Out of Pocket Max | $5,000 | $6,350 |

| Deductible (Annual) | $0 | $200, $500, or $1500 |

| Coinsurance | 90% | 80% |

For more information about the Student Defender plan, click here!

What is a waiver form?

Some students can find other insurance plans more affordable or more suitable for their needs, but most schools allow them to explore other options as long as they meet their requirements.

A waiver form is a formal document where independent insurance companies or brokers can review the insurance requirements NYU establishes for all their students to guarantee that they are compliant with their guidelines.

How to Pick an Insurance Plan?

It’s very important to take into consideration some points before choosing a plan:

1. Restrictions: Some insurance companies have restrictions on online transactions or even to different countries due to security reasons.

2. Price: All of our plans work with age brackets and daily rates, so depending on the one that you are currently in, the price could be different. Depending on your budget, we can guide you to the best option for you.

3. Benefits: All of our plans are designed to cover you everywhere outside of your home country for eligible injuries or illnesses that could occur after the effective start date of the plan. However, your school will probably share with you a list of requirements that you need to meet, plus we also take into consideration your personal needs in case you are looking for particular benefits.

What should I do to start with the waiver process?

You can always contact one of our agents and we will be more than happy to help you to find the best option plan for you based on your profile and your school requirements.

We offer different plans depending on the type of visa you have. For F1 students, our popular option is our Student Defender plan, which you can review here: F1 Insurance Plan for NYU.

For our J visitors, scholars, and Exchange Visitors we have several options, including some that work for dependents. You can review them here: J-1 Plans for NYU.

We strongly recommend you contact us before purchasing the plan to guide you in the process and to point you to the most suitable option for you.

We are available Monday through Friday, 8 am – 6:30 pm EST.

Toll-Free: (877) 758-4391

Direct: +1 (904) 758-4391

You can also email us your inquiries and questions to info@internationalstudentinsurance.com

What will happen after the purchase?

The purchase is very simple. Once you complete the payment, you will receive all your insurance documents via email for your convenience.

However, some schools provide the students with a form and request the insurance company complete it to confirm that the current plan the student is enrolled in is compliant.

We will be happy to help you fill out the form; the process typically takes 2-3 business days. Once it’s done, we send a copy to you and your school. You must simply email us your policy number and waiver form filled out with your information to info@internationalstudentinsurance.com.

If you have any questions or need assistance please contact us!

The Cornerstone of Trust: Delivering Exceptional Customer Service

April 12th, 2024 by Juan ReyesIn the realm of financial security, where complex products intersect with potentially stressful situations, exceptional customer service becomes the cornerstone of trust and successful experiences. While competitive rates and comprehensive coverage are essential, it’s the quality of human interaction that fosters long-term relationships and loyalty. This blog explores the key aspects that contribute to great customer service and their particular importance during the purchase of an insurance plan.

Transparency and Clear Communication

Insurance policies can be dense with legalese, leading to confusion and apprehension. Great customer service prioritizes transparency and clear communication. Representatives should explain coverage details, exclusions, and claims processes in a way that is easy to understand. Utilizing plain language, avoiding technical jargon, and providing clear written materials empower customers to make informed decisions and feel secure in their understanding of the policy.

Empathy and Emotional Intelligence

Purchasing insurance often stems from a perceived vulnerability, whether protecting one’s health or loved ones. Exceptional customer service recognizes the emotional component of the process. Representatives who demonstrate empathy and emotional intelligence can foster a sense of security in the customer.

Responsiveness and Efficiency

Time is valuable, and a prompt response demonstrates respect for the customer’s time. Whether answering questions, providing quotes, or processing applications, efficient service conveys professionalism and builds trust. Offering multiple communication channels (phone, email, online chat) caters to customer preferences and ensures accessibility.

The Importance of Customer Service in Insurance Purchase

In a competitive insurance market, exceptional customer service offers a distinct advantage. Here’s why it’s particularly crucial during the purchase of an insurance plan:

- Reduces Decision Fatigue: The abundance of insurance options can be overwhelming. Customer service representatives who take the time to understand individual needs and tailor presentations can significantly reduce decision fatigue and simplify the selection process.

- Increases Confidence: Clear communication and transparent explanations build trust and empower customers to make informed decisions with confidence, knowing they’ve chosen the right plan for their circumstances.

- Builds Loyalty: Positive interactions during the purchase process create a lasting impression. Customers who feel valued and understood are more likely to remain loyal to the insurer and recommend them to others.

- Mitigates Risk of Claims Disputes: A thorough understanding of the policy details fosters clear communication when filing claims. Customers who feel they were treated fairly during the purchase are likelier to have a smooth claims experience.

Exceptional customer service isn’t just about politeness; it’s a strategic approach that builds trust, fosters long-term relationships, and ultimately drives sales success in the insurance industry. Be sure that in International Student Insurance, customer service representatives will prioritize clear communication, empathy, and a genuine understanding of your needs, as they would not simply present product features; they will engage in active listening to uncover your unique circumstances, risk tolerance, and compliance goals. Their personalized approach fosters trust and allows tailored communication, ensuring your confidence in your chosen plan.