The University of South Florida has selected ISI as a pre-approved insurance option for international students. Learn more and apply online to meet your school’s requirements.

The summer is almost gone and the list of things for international students to do before classes start is a long one. Among the many deadlines that are approaching soon for students is the cut-off date for submitting an alternate international student health insurance plan to their school.

If you are among one of the 1,400 international student at the University of South Florida (USF) you have until August 27 to decide if you will keep the USF insurance plan or purchase another plan that will meet the USF compliance form requirements. This means there is not much time left to shop around for alternative international student insurance for the University of South Florida.

If you choose to explore your other options for International Student Insurance for the University of South Florida it is important to look at not only the price of the alternate plan but also the included benefits and exclusions. Saving money on the premium of your plan is important but not racking up multiple medical bills due to a lack of insurance coverage is even more vital.

One popular StudentSecure-USF plan is a pre-approved option for The University of South Florida and will save you money while still giving you comprehensive coverage.

ISI’s Student Secure-USF Plan: $741

University of South Florida Insurance Plan: $2,957

Total Savings with the Student Secure Plan: $2,215!

If you decide to purchase the StudentSecure-USF plan, you will not need to complete a compliance form as we will simply notify your school about your insurance plan and you will be able to start enrolling in classes!

If you would like more information on International Student Insurance for the University of South Florida or to purchase the Student Secure-USF plan, contact one of our licensed agents today.

Updated: July 29, 2020

In recent years, there have been more and more international students from Australia coming to study in the United States. In 2011 there were over 3,700 Australian international students in the US. Many of these students are athletes who will be playing in a school sport such as soccer. Many international student insurance plans do not include intercollegiate sports coverage, that’s why International Student Insurance is now featuring our Australian athlete student health insurance plan. This plan is designed to meet the needs of international students from Australia who will also need coverage for any school sport related injury.

Our Australian athlete student health insurance plan is called the Student Health Advantage plan. This plan will provide coverage for up to $5,000 per injury or illness relating to intercollegiate and interscholastic sports. Not only does this plan provide coverage to students while on the field but it also provides great coverage for sickness or injury that might occur while off the field as well.

This plan will provide medical coverage up to $500,000 and features a low $5 co-pay for treatment received at the Student Health Center.

Other benefits on this plan include:

Australian International Student Athletes can purchase this plan for as little as one month of coverage or as much as 12 months. If the plan is purchased for a full 12 months, it will be renewable the following year up to a total of five years.

For more information about our Australian Athlete Student Health Insurance, please contact one of our insurance representatives to provide you with further information today.

International Student Insurance offers the Student Secure plan which meets and exceeds the requirements at Florida International University.

International students at Florida International University (FIU) must have international student health insurance for Florida International University in order to enroll in classes. If you are a student at FIU and have a hold on your account, it might be due to the lack of a health insurance plan. Students can either purchase the insurance plan offered through FIU, or they must purchase an alternate health insurance plan that will meet the FIU requirements.

Students not yet sure what insurance plan they will purchase for the new school year should review the FIU plan along with other similar plans available to decide which plan will work best for them. International students trying to save money will especially want to explore their options.

One alternate option to the school’s international student health insurance for Florida International University is the Student Secure plan where the Budget, Select and Elite plan levels will meet. This comprehensive plan is available to students at FIU and will meet the necessary compliance form requirements. The best part is that this plan will save you money without you having to sacrifice coverage. A student that purchases the FIU health insurance plan will spend $2,923 for one year. However, a student that waives out of their school plan and purchases the Student Secure plan will only spend $513.24.

Florida International University plan: $2,923

Student Secure plan: $513.24

Total savings with the Student Secure plan: $2,409.76

If you would like to purchase a plan that has comprehensive international student health insurance for Florida International University that will save you money, you can purchase the Student Secure plan right online. After your plan has been purchased, simply complete the student portion of the FIU international student health insurance compliance form then email or fax it to us. We will then complete the insurance portion and get it to your school right away. This means you will be able to enroll in the classes you need then go out and celebrate the new school year with all of the money you saved!

Updated 8/5/2020

Students who are studying in Finland or are planning to in the near future will need to meet certain requirements when it comes to purchasing their Finland Travel Insurance. The Finnish Government regulates international students who will be studying in Finland to have the following insurance requirements met with their plan:

Finland travel insurance plans that meet these requirements and have a $0 or $100 deductible are usually considered favorable and approved by the Finnish government.

International students studying in Finland now have a new plan option that allows them to purchase coverage that will meet the Finnish requirements and pay in Euros: the Europe Travel Insurance Plan. To give you an idea on how this plan will work for you, if you will be an international student in Finland for three years, the Europe Travel with €40,000 coverage and a €0 deductible/excess would meet your Finnish government requirements. If you will be an international student in Finland for only one or two years, the Europe Travel has €400,000 in coverage and a €0 deductible, which meet the Finland travel insurance government requirements.

The benefit amounts included in this plan are listed in Euros which takes the guess work out of converting different currencies. Also, this plan can be purchased for 365 days and give an individual a credit card or bank transfer payment option.

This Finland Travel Insurance plan will not only meet the government guidelines, but is easy on the student budget as well:

If you would like to purchase your Finland Travel Insurance, contact one of our licensed agents today to learn more.

School is just around the corner, and many of you are enjoying your time abroad. As we reported back in July, it’s important to keep up to date with the international environment. The Department of State in the United States monitors the global climate to make sure that you are informed about the latest current events and how they may affect your travel plans. Here are the latest in travel warnings summarized to give you an overview of August 2012 Travel Warnings:

The Department of State has a Smart Traveler Enrollment Program (STEP) available to US citizens who want to stay informed of the latest updates. If you will be in an area that has existing travel warning or alert, as listed in our August 2012 Travel Warning, you can also provide your contact information in case an emergency happens while abroad.

If you are an international student in the US and have either our Student Secure or our Atlas Travel Medical plan with us, you know that you are covered if you ever get sick or injured while in the United States. However, you may wonder how to find a doctor to go to in case you do get sick. Good news! You can choose whichever doctor or hospital you want to go to! Our plans do not limit you to a specific doctor when you receive treatment.

However, we do recommend that you go to a doctor or hospital that already has an agreement with the insurance company. We refer to these doctors/hospitals that already have an agreement with the insurance company as in-network providers. By choosing to go to an in-network provider, you will benefit in the following ways:

International students who are asking how to find a doctor to go to will find it’s simple to find the provider they need. Our network is nationwide, so wherever you are in the USA, you won’t have a problem finding a doctor near you. When using our online provider search tool that is located directly on our website, finding a doctor is easy. You can access this tool by click on the link above or by typing www.internationalstudentinsurance.com/network into your web browser address bar.

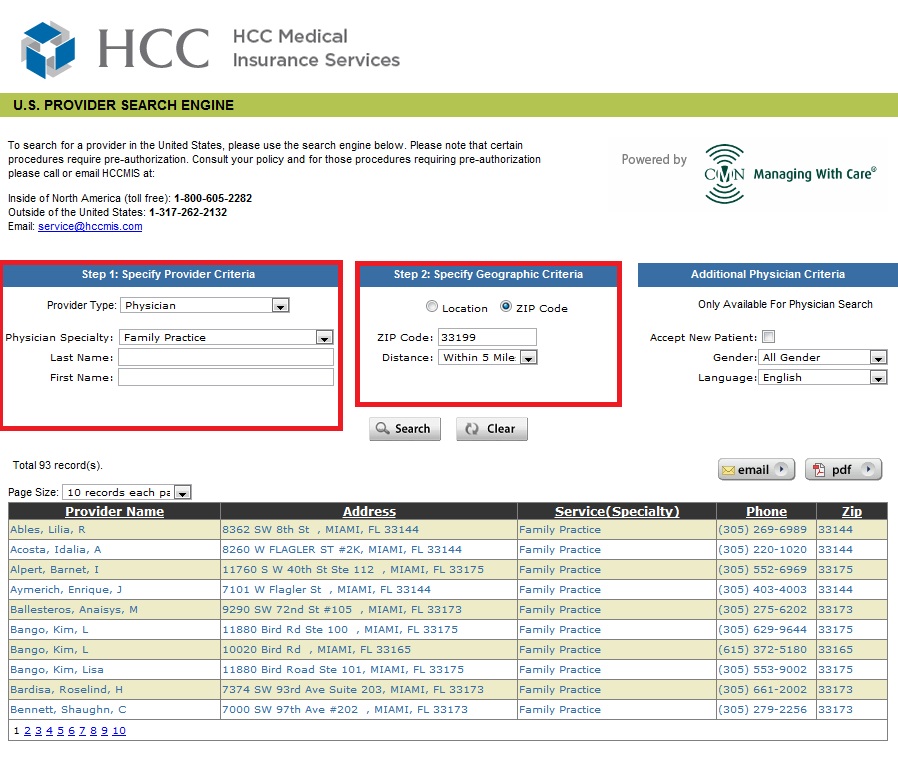

You will see this page when you click on the link.

Once you are on this page, you will need to click on “USA Network” to find a doctor or hospital inside of the United States. A new window will appear that allows you to get started on your search. In step one you can choose the type of provider you are looking for, for example, if you are looking for a hospital choose “General Acute Care Hospital.” In our example below we chose “Physician” and “Family Practice” under “Physician Specialty,” this is generally what you should look for if you are just looking for a general doctor because you feel sick or have a minor injury.

On step two, click on “ZIP code” and enter the zip code of the area that you are trying to find a doctor in. In our example, you can see we have searched for a family practice doctor within five miles of the zip code 33199 in Miami, our results have 93 different doctors to choose from.

If you already have the Student Secure plan or the Atlas Travel Medical plan with us and still need assistance on how to find a doctor or more information on how to use your insurance, please call our client relations department at the number located on the back of your insurance ID card. Our client relations department is available for you 24 hours a day, 7 days a week.

If you don’t have a plan with us yet but would like to know which one would work best for you, please contact our insurance agents to find the best insurance plan for you.

It is almost August meaning the end of summer is getting closer. Between days at the pool, mowing the lawn repeatedly and trying to stay cool, the past few months might have flown right by. However, if one of your goals this summer was to travel abroad, all is not lost yet. There are still a few weeks left before classes will start back up that you are able to take that desired trip to a location around the world like Italy, China or Brazil.

If you have been saving for your trip abroad only to find out at the last minute that your friends have not, there are multiple outlets available that give you the option to travel with a group. There are multiple organizations that host trips abroad and enable students to meet new friends while gaining a cultural experience. A few places to search for programs available to students include GoAbroad, Summerfuel and Transitions Abroad.

After your trip is booked you will need to contact your insurance company to see if your current plan will cover you while outside the US. If not, you want to purchase travel abroad insurance.

One popular travel abroad insurance plan that individuals are able to purchase while travelling outside of their home country, is the Atlas Travel plan. The Atlas Travel plan does not require individuals to be a student during their coverage period and can be purchased for a minimum of 5 days. Since same day coverage is available with this plan, this means you still have time to squeeze in your sought after summer trip abroad and have the insurance coverage you will need during your travels.

If you are able to fit in a trip overseas before your new classes begin and would like more information on the Atlas Travel plan or other travel abroad insurance plans, contact one of our licensed agents today.

As the new school year is right upon us and many students are attending student orientations and registering for classes, most schools require that students purchase international student health insurance coverage either from them directly (the schools plan) or they can show proof of adequate, alternate coverage. With school plans costing upwards of $2,000 per year, that can be an expensive option – so it’s always good to look for other alternatives.

When looking for plans DO NOT just look at the monthly price! Although there are attractive options out there, you MUST look at the benefits and features since these plans could put you in more financial trouble if you get sick or injured.

To help you out – here are some of the top items to watch out for:

Tip #1 – Policy Maximum/ Coinsurance

When a plan states their policy maximum, ALWAYS look at the coinsurance that goes along with that plan. Coinsurance is the amount you will be paying towards your insurance plan if you get sick or injured – ideally you want this capped out, so that your coinsurance is only applicable up to a certain dollar amount.

Some plans, have their coinsurance setup like this:

Policy Maximum – $200,000

Coinsurance – 100% up to $40,000 and then 80% up to policy maximum

Look very closely for plans like this. Take, for example, if you get hospitalized and it can costs $100,000 – the plan will pay 100% up to $40,000 and then only 80% of the remaining $60,000. This means you will be left with a bill of $12,000 to pay!!

Ideally, you want your plan to be written something like this:

Policy Maximum – $200,000

Coinsurance – 80% up to $10,000 and then 100% up to policy maximum

With this scenario, there is a maximum you will pay out of pocket of just $2,000 since it is capped! In the other scenario, you could owe thousands of dollars!

Tip #2 – Cap on Medical Benefits

Look out for plans that cap actual medical benefits – things to be careful of are:

Tip #3 – Payment Flexibility

We all know that money is tight as a student – so look for plans that offer you the functionality to pay for your plan in monthly installments. You can spread the cost of your insurance over the year, and it avoids you having to pay all upfront for a full year of coverage!

Tip #4 – Sport Coverage

If you’re in college, you will most likely be playing sports in some shape or form – therefore you will want a plan that covers you if something happens when you are playing sports. Look out for plans that do not cover sports related injures such as intercollegiate, intramural and club sports! You do not want to have an injury and have to cover the full cost of your medical treatment.

Hopefully these 4 tips will help you choose the right plan – and help you avoid the common pitfalls. You do not want to end up paying more than you need to when a plan a few dollars more will cover you 100% for most injuries and illnesses!

Most colleges and universities have insurance requirements that international students must meet before they are able to enroll for classes. International students participating in sports must have insurance that also includes sports coverage. Students looking for a student health insurance plan that will cover them during their studies outside of their home country and that also includes organized sports coverage might be interested in the Student Secure plan.

The Student Secure plan comes in three levels: smart ($200,000 in coverage), budget ($250,000 in coverage) and select ($300,000 in coverage). The budget and select level of this plan have organized sports coverage for basketball, baseball, cross country, dance team, football, golf, kickball, soccer, softball, swimming, tennis, track, volleyball, weight training and wrestling.

Covered individuals on the Student Secure plan who are participating in intercollegiate, interscholastic, intramural or club sports will have medical expense coverage up to $5,000 per injury or illness.

The Student Secure plan automatically includes the organized sports coverage without an additional fee. This means that as an international student participating in your school’s sports, you can have the coverage that you are not only required to have, but the coverage you will need for your active lifestyle. The Student Secure plan gives international student athletes the chance to focus on what really matters: their game. International individuals who are on OPT and maintain a valid F1 visa are also eligible to purchase this plan.

A few of the other benefits included in the Student Secure plan are doctor visits, emergency medical evacuation, emergency dental, accidental death and dismemberment, local ambulance, emergency reunion, repatriation of remains, maternity and mental health.

If you would like more information on the organized sports coverage in the Student Secure plan or if you would like to purchase this plan over the phone, contact one of our licensed agents for assistance today.

There are more than 130,000 international students studying in Japan each year, making Japan is a popular destination for students from all around the world to study in as well to travel. During the 2010-2011 year there were over 6,000 international students studying in Japan from the US alone. Many international students elect to purchase separate student health insurance for Japan to cover any potential costs not covered by other plans.

Known as the “Land of the Rising Sun” Japan is a small island country, yet it has the 3rd largest economy in the world. Home to many high tech companies such as Sony and Toyota, Japan is a great place to study with its rich history and culture. It’s one of the safest countries and also has great transportation options for students looking to explore the country.

While international students in Japan are covered by the Japanese national healthcare system, which only provides 70% coverage on many services. In the event of an emergency, the student would still be responsible for the 30% of the cost. Expenses such as the cost of a bed in a private hospital room may not be covered at all.

Some universities in Japan also have their own health insurance available. Students should also check with their school to see what coverage is available through the school. However, for those who are looking to have more comprehensive coverage should consider purchasing an international student health insurance for Japan. By having a private insurance, students would then be covered for costs that are not covered by the national healthcare such as private medical care, repatriation, evacuation, trip interruption, 100% coverage etc.

For more information about our insurance plans, and to see a full overview of the plans available, please see our dedicate Japan Student Insurance section.

Japanese image provided by Shutterstock