When a claim has been processed by your insurance company, you will most likely receive an explanation of benefits – or for short an EOB. This document will outline to you what charges were received and reviewed by your insurance company, and what action was taken. In most cases the EOB will list out all those charges that were received, what they were for, what was paid or denied and the reasons behind those actions.

When a claim has been processed by your insurance company, you will most likely receive an explanation of benefits – or for short an EOB. This document will outline to you what charges were received and reviewed by your insurance company, and what action was taken. In most cases the EOB will list out all those charges that were received, what they were for, what was paid or denied and the reasons behind those actions.

Like many international students, and even seasoned professionals like ourselves, EOB’s can sometimes be a little tricky to understand at first glance. However nearly in every case, it takes just a few minutes to read the EOB more carefully, and to look out for certain items – and the EOB is no longer as confusing!

This blog post is designed to guide you through the EOB maze, so you know what to look out for and how to read them.

How do I receive my EOB?

The method in which your EOB is delivered to you will vary from one insurance company to another. However, you will want to try and make sure these are delivered electronically – either through an online portal or via email. This will be the quickest and simplest method, because if you are only abroad for a few months and the EOB is mailed to you – in many cases you might not even receive it. So its pretty important to make sure your insurance company can email or deliver your EOB electronically. If they can’t do that, make sure you update your address on file. If you do not receive your insurance EOB’s, and they are informing you to complete a claim form and that is not received, the claim will be closed and you will have to pay all those expenses.

What does an EOB look like?

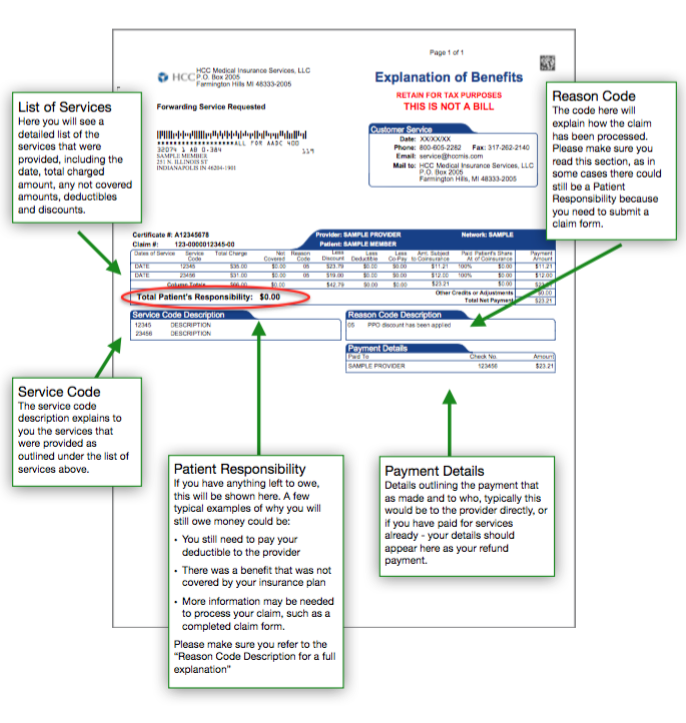

EOB’s vary in their format from insurer-to-insurer, but in most cases they include very similar information just in a different format. When you purchase one of our main Student Health or Travel Medical insurance plans, your EOB’s will be available electronically through MESA in your Student Zone and they will look like this:

Important EOB Sections

There are a number of line items and sections to most EOB’s, in the example above the main items you need to look for – and pay attention to are:

List of Services

In this section, you should see a list of all services that were provided and billed to your insurance company, along with full details about what expenses were not covered, those that were discounted, those that were applied to deductibles or coinsurance and then finally any amount that was paid out. It is important to note here that often times one trip to the hospital might have multiple charges from the actual hospital, from the attending doctor, etc… so do not be concerned with many line items listed here.

Service Code

The service code highlights the services that were performed, providing you with more description about the actual work that service relates to. In some cases, EOB’s might have a listing of number and codes on the back of the EOB for you to look up. In our example, the EOB lists this on the front of the document.

Reason Code

The reason code is a very important section to look for, as this highlights how the claim has been processed. For example if the claim was denied then it would be listed here in the reason code, likewise if the claim has not been paid because the claims team need a completed claim form – this will also be listed here.

Patient Responsibility

This section will show what you still need to pay the medical provider. It is important to note that even though your claim has been approved and accepted, you could still have a patient responsibility that you owe to the provider that treated you, such as a deductible or coinsurance. A patient responsibility does not necessarily mean your claim has been denied, so it is very important to cross reference this with reason code to check on how the claim was processed.

Payment Details

This very simply outlines what has been paid and to whom.

Of course, if you have any questions about Understanding Your Explanation of Benefits (EOB) through one of our plans – please do not hesitate to contact our team who will be happy to help you understand how your claims were processed!

Category: Insurance Explained

Tags: eob, explanation of benefits, understanding eob, understanding insurance